Unlock Your Financial Possible With Hassle-Free Financing Services You Can Depend On

In the world of individual financing, the accessibility of convenient funding solutions can be a game-changer for people aiming to open their monetary potential. When looking for economic help, the integrity and credibility of the car loan company are extremely important factors to consider. A myriad of finance options exist, each with its very own collection of considerations and advantages. Recognizing how to browse this landscape can make a substantial difference in attaining your economic goals. As we check out the realm of hassle-free finances and trusted solutions further, we uncover essential insights that can encourage people to make informed choices and protect a stable financial future.

Advantages of Hassle-Free Loans

Problem-free fundings supply borrowers a structured and effective method to accessibility financial support without unnecessary issues or delays. In contrast, problem-free fundings focus on rate and benefit, offering debtors with quick accessibility to the money they require.

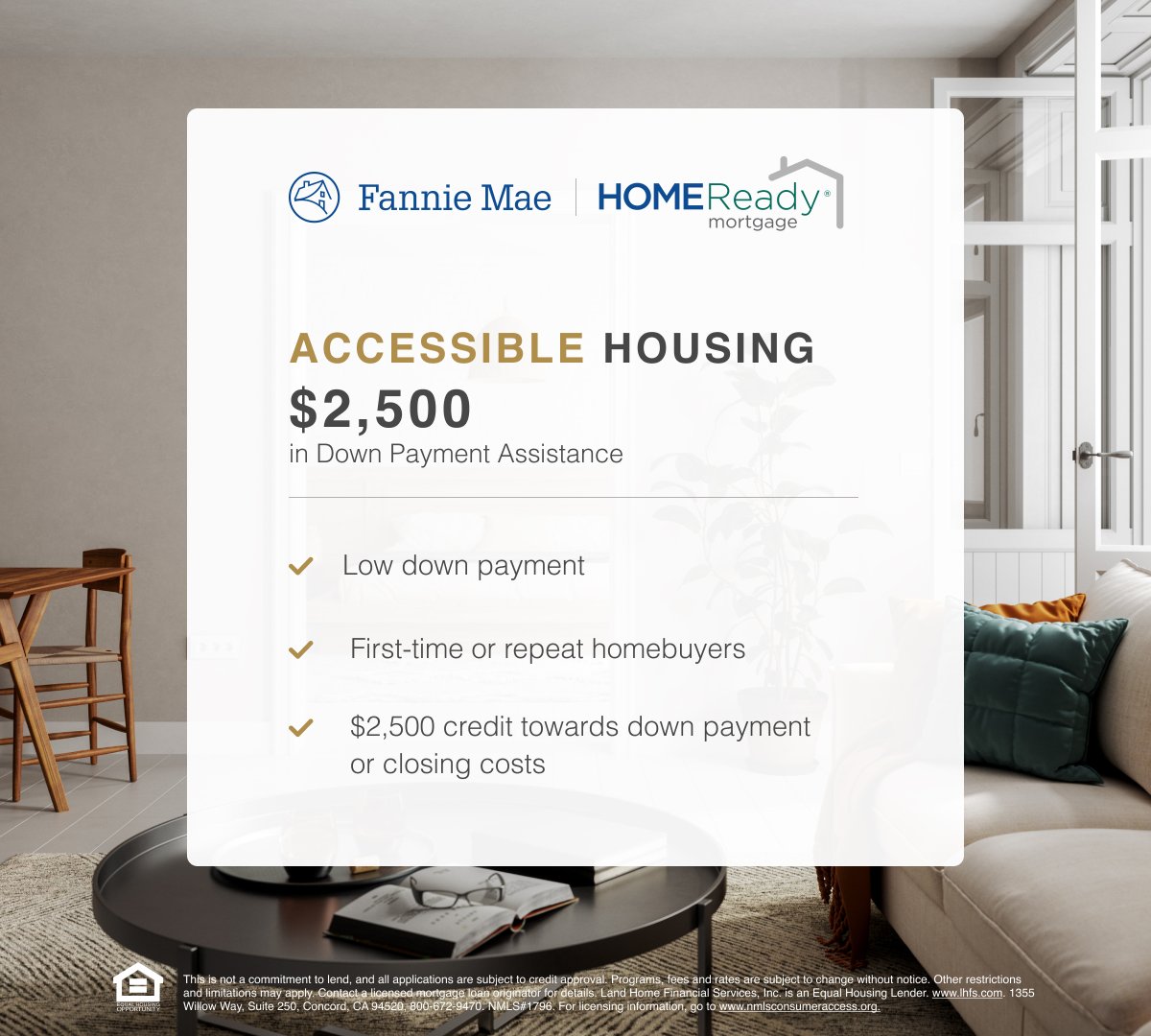

Moreover, convenient lendings normally have minimal qualification standards, making them obtainable to a more comprehensive variety of individuals. Typical lending institutions usually need comprehensive documents, high credit report, or collateral, which can leave out several possible consumers. Hassle-free fundings, on the other hand, concentrate on price and adaptability, offering aid to people who might not fulfill the rigid needs of typical banks.

Types of Trustworthy Lending Provider

Just How to Get a Finance

Exploring the essential qualification requirements is vital for individuals seeking to qualify for a funding in today's financial landscape. Offering current and exact financial info, such as tax obligation returns and financial institution declarations, is important when applying for a car loan. By recognizing and satisfying these qualification standards, people can improve their chances of qualifying for a funding and accessing the monetary help they require.

Handling Lending Payments Carefully

When debtors effectively protect a financing by fulfilling the vital eligibility criteria, prudent monitoring of lending settlements comes to be extremely important for keeping financial stability and creditworthiness. Timely settlement is critical to avoid late fees, charges, and unfavorable effect on credit rating. To manage lending payments wisely, customers must produce a spending plan that includes the month-to-month settlement quantity. Establishing up automatic settlements can assist make certain that payments are made in a my link timely manner every month. Additionally, it's recommended to prioritize lending payments to stay clear of falling back. In instances of financial problems, interacting with the lending institution proactively can sometimes result in alternative repayment arrangements. Monitoring credit scores records on a regular basis can also help debtors remain educated regarding their credit standing and recognize any inconsistencies that might require to be addressed. By managing funding settlements sensibly, borrowers can not only accomplish their monetary obligations yet also construct a favorable credit rating that can profit them in future economic ventures.

Tips for Picking the Right Financing Alternative

Selecting the most ideal loan alternative includes comprehensive research and factor to consider of individual financial demands and circumstances. Consider the lending's complete cost, settlement terms, and any type of added charges linked with the car loan.

Moreover, it's necessary to choose a loan that straightens with your economic goals. If you need funds for a details objective like home improvement or financial debt loan consolidation, opt for a loan that fulfills those needs. Additionally, read the funding agreement thoroughly, guaranteeing you comprehend all conditions prior to finalizing. Look for recommendations from financial experts if required to ensure you make an enlightened decision that suits your economic situations. By adhering to these pointers, you can confidently choose the best car loan choice that assists you attain your monetary goals.

Conclusion

To conclude, unlocking your economic capacity with hassle-free funding services that you can rely on is a liable and wise decision. By understanding the benefits of these financings, understanding how to qualify for them, taking care of settlements wisely, and choosing the right financing choice, you can attain your financial goals with confidence and assurance. Trustworthy funding services can provide the support you need to take control of your Full Article financial resources and reach your desired end results.

Safe finances, such as home equity financings or vehicle title lendings, allow customers to use collateral to safeguard reduced passion prices, making them a suitable selection for individuals with beneficial properties.When debtors effectively protect a financing by satisfying the vital qualification standards, prudent monitoring of lending payments ends up being vital for maintaining financial security and creditworthiness. By taking care of finance repayments responsibly, borrowers can not only fulfill their economic obligations however also develop a favorable credit history that can profit them in future economic undertakings.

Consider the lending's complete price, payment terms, and any type of extra fees associated with the financing.