About Hard Money Loans

Table of ContentsSome Known Details About Commercial Loans 8 Simple Techniques For Private Money LendersOur Precision Capital DiariesThe Best Guide To Lenders Near MeWhat Does Lenders Near Me Do?Not known Facts About Private Money Loans

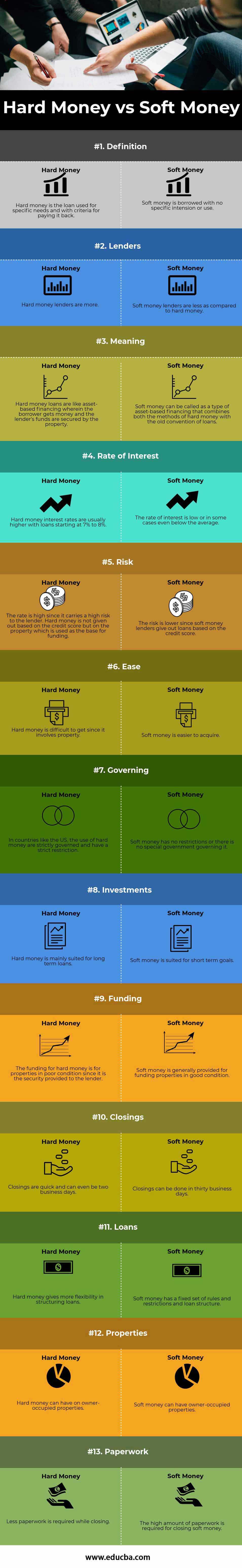

The consumers' credit scores record does not play a part in the approving of such financings. All the lending institution is worried about is the equity in the residential or commercial property and also the credibility of the documentation sent. One such reason an individual might look for a difficult cash financing is to stay clear of repossession, residence turning, or any kind of circumstances of a requirement for quick cash money.In the instance of someone flipping a house, the goal would certainly be to settle the lending after marketing the residential property. You can use difficult money resources to obtain a readily available residential property on the marketplace and afterwards seek refinancing to acquire a finance with a reduced rate of interest price to pay back the hard cash funding.

It is just the property files that will go through analysis and also authentication. Lenders are rarely stressed about difficult money financings being repaid, as they have actually ensured that the property vowed with them as security is worth much even more than the quantity of the lending, consisting of the interest.

See This Report about Fix And Flip

The only protection that lending institutions have when offering out hard money loans is the residential property they receive as security. Consequently, most lenders will not use even more than 50 to 70 percent of the home's worth. The amount of the car loan vs. the residential property's value secures the lender versus feasible market variations in time.

A knowledgeable and successful residence flipper of property may fall in this category. Passion prices for tough cash financings are high as well as will be even greater than those offered for subprime lendings. Subprime rates are more than the prime rates and are in force for financings to people with poor credit.

They might ask a few standard details concerning securing the financing, the project the money is moneying and various other little points to establish a partnership with the consumer. They will, nevertheless, make an in-depth study of the residential or commercial property papers, confirm the credibility, and at times might also choose to evaluate the property conditions.

Private Money Loans Things To Know Before You Get This

Many hard cash consumers will certainly typically go back to the exact same lender after repaying a previous lending when they require cash again. In such situations, authorizations will be also quicker, and also frequently much more substantial financing might be readily available. When it comes to hard cash ventures, agreements are between the debtor as well as capitalist.

These strategies should be reasonable as well as not just optimistic to ensure the advantages exceed any drawbacks. If you are looking at difficult money as a lifeline, it is nearly particular that you will lose your property to the individual or investor lending you money. It is vital to take into consideration the prices of difficult money financings prior to participating in any kind of contract.

An Unbiased View of Precision Capital

To include in that, the amount of money you obtain is the regarded value. Depending upon the scenario and also capacity to settle the lending in a brief quantity of time, make sure to evaluate your options of hard cash offering vs. traditional loan informative post providers that will accept your home as security for an extended period.

Remember you have to sell the property that you have actually bought with the hard cash promptly as well as not wait for several market upturns, even if you have to do so at a reduced cost. Passion can develop quickly, so the faster you can offer a home, the reduced the amount of passion you will need to pay.

No matter of the type of finance you pick, if you back-pedal a car loan, it can substantially impact your capability to get lendings or credit score in the future. Skipping on your tough financing repayment also means you shed the possession you put up as collateral. The loan provider can market your home for any type of amount they pick to cover the funding's worth and also any accrued passion (Precision Capital).

Excitement About Lenders Near Me

The lending institution will certainly have no passion in looking for the finest cost but will only visit this website see that his investment has been met. Hard cash loans can be a fantastic method to assist you attain your monetary objectives. You should have a strategy in place to rapidly repay the car loan.

A tough cash loan functions as an asset-based car loan, meaning that while hard money loan providers take into account the capitalist's credit rating, this is not an essential variable in establishing his or her eligibility. Rather, lending institutions require that you use real estate home as security. They make use of the cost of the building to calculate the threat of the lending and also the Financing To Worth (LTV).

The major factor investor select to use for a tough cash car loan is that private lending institutions can money the bargain within a weekor much less if the debtor meets all the qualifications. HML's job excellent on short-term flips as well as rehabs, or click for more info for novice acquisitions, yet on longer-term investments, HML's are not the most effective concept.

Hard Money Lenders - An Overview

They both have similar requirements for lending. Bridge financings are solely for acquiring realty residential or commercial properties or financial investment residential properties that don't receive conventional borrowing programs. A bridge car loan can likewise be used as a down payment for a new home when the buyer hasn't offered their existing house.

Hard cash lendings likewise functions similarly to swing loan If you intend to discover more on just how to obtain a fix as well as turn or difficult money loan, call us we would certainly like to address your inquiries.